In an attempt to rein in the private providers of ophthalmology services, NHS England has just launched a consultation to reduce tariff prices for three of the most common procedures.

The proposed changes could result in 20 independent sector hospitals losing a total of £64m, with NHS providers gaining a similar amount, according to the NHSE impact assessment.

The reduction in payments, noted by the NHSE, will allow money to be redirected to other ophthalmology services.

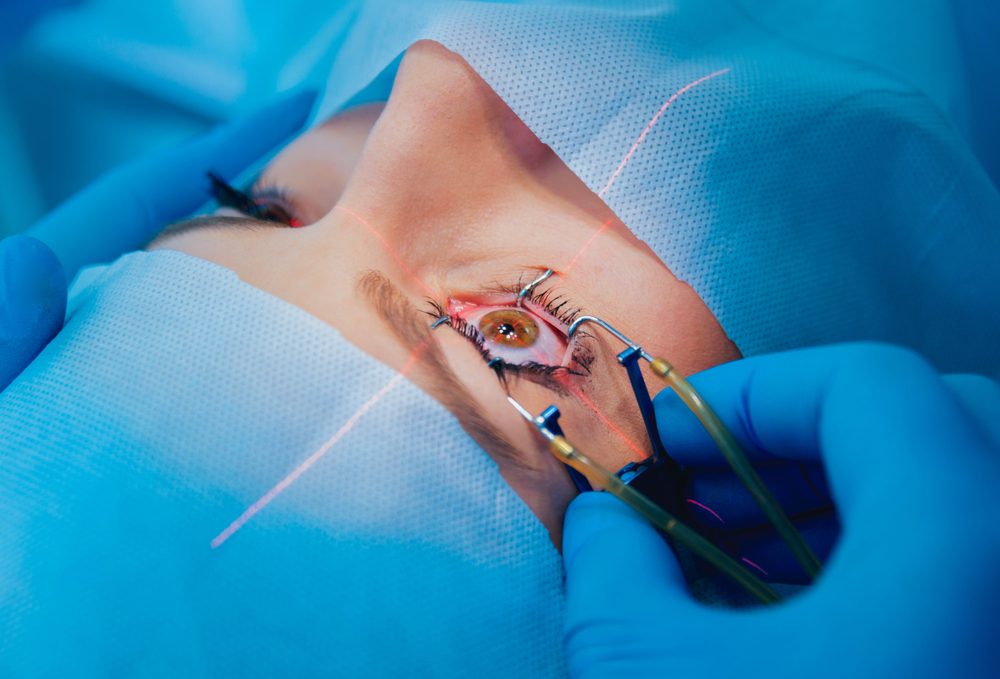

The consultation follows years of concern over the impact the private sector has had on the ophthalmology area. There has been a massive expansion of NHS-funded cataract surgery, perhaps the most straightforward of ophthalmology procedures, by private providers. The consultation notice, published by NHSE on 8 July, stated that cataract activity had nearly doubled to more than 450,000 treatments between 2017-18 and 2023-24.

On the back of so much NHS work, the top five companies have opened 101 new eye clinics between them over the past five years, taking the total to 126 in England. They have received millions each year, much of which has gone in profit to investors and to pay off company debts, according to the CHPI.

The effect of the rise of these private eye clinics has been significant on ophthalmology departments in NHS hospitals, with warnings of the destabilizing effect of the expansion of the companies on NHS staffing levels, training and on the finances of ICBs back in 2022, and repeated regularly, most recently in a DHSC briefing to Wes Streeting in November 2024.

The November 2024 briefing detailed concerns about the impact of the five main companies: SpaMedica, CHEC, Newmedica, Optegra, and ACES. It outlined how money and expertise were being drained from the NHS.

“NHS England has concerns covering value for money, unnecessary operations, impacts on workforce and training, poor follow-ups and patient safety.”

A recent analysis of NHSE data of private sector activity in the NHS by the Independent Hospital Provider Network (IHPN) showed that ophthalmology was the leading area for private sector activity in 2024/25, accounting for 35.3% of activity.

Targeting tariff prices to control/change the market has been attempted before, however, when the NHSE cut some prices in 2024, including for cataracts, halfway through a two-year payment scheme.

There was however some criticism of the change, from both the industry as expected, but also from the Royal College of Ophthalmologists, which said the NHSE had “not shared its data or modelling… the reduction may mean that the costs of operating on patients with complex needs is not properly reflected”.

At the time, Professor Burton, President of the Royal College said: “We would like to see independent sector capacity in ophthalmology being commissioned in a controlled [and] planned way, with consensus between commissioners, clinicians and NHS providers about where that capacity is needed.”

A spokesperson for the college told HSJ they would be responding to this new consultation, which they called “timely and pertinent”.

Dear Reader,

If you like our content please support our campaigning journalism to protect health care for all.

Our goal is to inform people, hold our politicians to account and help to build change through evidence based ideas.

Everyone should have access to comprehensive healthcare, but our NHS needs support. You can help us to continue to counter bad policy, battle neglect of the NHS and correct dangerous mis-infomation.

Supporters of the NHS are crucial in sustaining our health service and with your help we will be able to engage more people in securing its future.

Please donate to help support our campaigning NHS research and journalism.