Unusually revealing figures in the end of May Board Papers for the troubled Shrewsbury and Telford Hospitals trust make clear that the trust as a whole is running at a loss:

“At month 12 the overall profitability for the Trust was 7.25% loss.”

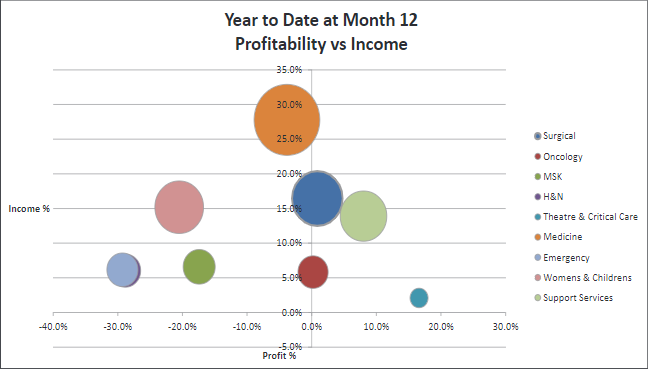

This cryptic comment is followed by a bubble chart, placing coloured bubbles that show the relative size of income from various specialist services on a scale that ranks them according to whether the service is profitable or loss making.

Medical specialities are by the largest loss makers with the bulk of services running up to 10% in the red, although women’s and children’s services are another large specialist area running even deeper in the red zone, with deficits of 15-25%.

Emergency services, a relatively small portion of income, generate a higher level of loss, with costs of delivering the service outstripping the tariff payment by around 30%. Musculoskeletal services run at a 15-20% loss.

Cancer services appear divided down the middle with half losing and half in surplus, surgery is two thirds in the profitable zone, but delivering no more than 5%. Theatre and critical care services deliver consistent surpluses of 15-18%, but are small in scale.

So overall it’s clear that this hospital trust would not be a going concern anywhere other than in the NHS. Two obvious conclusions:

- trusts like this will never be seen by US health corporations as potentially profitable targets to take over:

- and, trust deficits are driven by serious under-funding of these core services – and they cannot be ended without brutal cuts in core services that would inevitably cause a major public outcry.

Dear Reader,

If you like our content please support our campaigning journalism to protect health care for all.

Our goal is to inform people, hold our politicians to account and help to build change through evidence based ideas.

Everyone should have access to comprehensive healthcare, but our NHS needs support. You can help us to continue to counter bad policy, battle neglect of the NHS and correct dangerous mis-infomation.

Supporters of the NHS are crucial in sustaining our health service and with your help we will be able to engage more people in securing its future.

Please donate to help support our campaigning NHS research and journalism.