Spire Healthcare has stated that it is “cautiously optimistic” that trading and profits will bounce back to 2019 levels after reporting income down by 6.2% to £920m during 2020, not least because of increased contract work for the NHS.

Sales picked up in the second half of the year, with “exceptionally strong growth” in self-pay revenue in quarter 4, and Covid-19 contracts bringing in £363m of the £430m of NHS funded treatment – up from £286m in 2019. In other words NHS payments made up almost half (47%) of total revenue.

Reviewing the outlook the company notes the “positive dynamics in our market have not changed with lengthening waiting lists and significant demand in both the NHS and private sector resulting from the postponement of elective procedures during the pandemic.” leading to “double digit growth in self-pay revenues in Q4 20 and January 2021.”

The company is reassured by “positive” underlying trends, “with … a waiting list of private surgery and significant national unmet demand for both NHS and private diagnostics and procedures”.

Australian-owned Ramsay Health Care, the private hospitals which treated the largest number of NHS patients last year saw its UK revenue fall by just 2.4% in the six months to December 2020, while private patient income dropped 82.5% to just $86m. The difference was made up by increased British government payments, which made up the bulk of its UK revenue ($394.5 out to $480.9m).

But Ramsay, too, is looking to a continued increase in private self-pay patients as well as more work funded by the NHS to help bring its balance sheets back into surplus.

Meanwhile, the private hospital sector in London is looking back nostalgically at the bumper profits from 2019, when revenues rose over 7% from the previous year, and wondering whether the good times will roll again. Different companies notched up widely varying results, with revenue rising from as little as 3.4% (HCA) to 15% in the London Clinic, but also faced a rise in overhead costs.

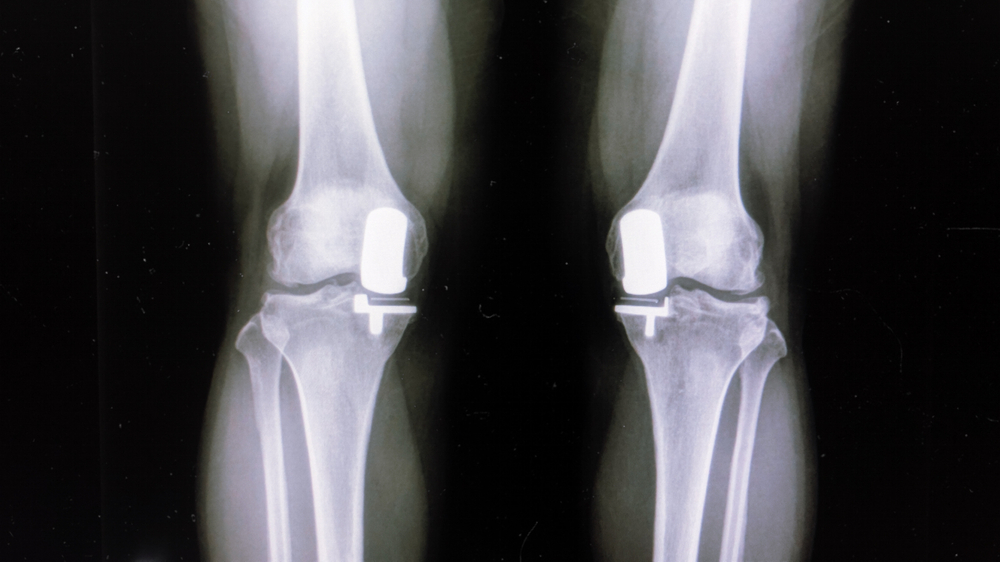

According to a new LaingBuisson report, oncology now accounts for the largest single share of private hospital business in the capital (25%), followed by orthopaedics (16%) and cardiology and heart surgery (9%).

Schoen Clinic, a new entrant to the private market (with just one hospital and 39 beds) managed to capture 11% of the hip and knee replacements in 2019 and almost 20% in 2020 if NHS patients are included: but with inflated overheads driven by its employment of consultants rather than contracting them on a sessional basis, it managed to lose £18m on revenue of £16m.

More new hospitals in the capital due to open in 2022 (Nuffield Hospitals and Cleveland Clinic) are also expected to employ consultants, forcing up the fees that they can demand from other private hospital corporations as well as piling new potential pressure on an over-stretched, under-staffed NHS.

LaingBuisson note ruefully that “Since 2014 nearly half the profit in the independent sector has disappeared, and it is hard to see it coming back with expanded competition and increasing costs.”

Dear Reader,

If you like our content please support our campaigning journalism to protect health care for all.

Our goal is to inform people, hold our politicians to account and help to build change through evidence based ideas.

Everyone should have access to comprehensive healthcare, but our NHS needs support. You can help us to continue to counter bad policy, battle neglect of the NHS and correct dangerous mis-infomation.

Supporters of the NHS are crucial in sustaining our health service and with your help we will be able to engage more people in securing its future.

Please donate to help support our campaigning NHS research and journalism.